-

The 5-Minute Rule for Why Did My Car Insurance Premium Go Up?

If your state does not need you to have insurance, including bodily injury liability protection, you might be doing yourself a huge support if you're ever before found responsible for a mishap that created injuries to others (cheaper car). At American Family members, we'll compensate you when you enroll in My Account and pick paperless invoicing.

Cars and truck insurance coverage is necessary to protect you financially when behind the wheel.!? Here are 15 techniques for saving on vehicle insurance prices.

Lower cars and truck insurance rates might also be offered if you have other insurance plan with the same company. Preserving a safe driving record is vital to obtaining reduced auto insurance prices. Car insurance costs are different for each driver, relying on the state they stay in, their choice of insurance provider as well as the sort of protection they have.

The numbers are rather close together, recommending that as you allocate a brand-new automobile acquisition you might need to include $100 or so monthly for automobile insurance coverage. While some points that impact cars and truck insurance coverage prices– such as your driving background– are within your control others, expenses might also be affected by points like state policies and also state accident prices.

cheap car insurance cheapest car cheaper cheap auto insurance

cheap car insurance cheapest car cheaper cheap auto insuranceWhen you understand just how much is auto insurance policy for you, you can place some or every one of these strategies t work. If you get a quote from a vehicle insurance provider to insure a single car, you may wind up with a greater quote per automobile than if you inquired about guaranteeing several motorists or lorries with that said company (insurance affordable).

If your kid's qualities are a B standard or above or if they rate in the leading 20% of the course, you might be able to obtain a excellent student price cut on the coverage, which typically lasts until your kid turns 25 – accident. These discount rates can range from as low as 1% to as high as 39%, so make certain to reveal proof to your insurance representative that your teen is Browse this site a great pupil.

The Ultimate Guide To Teen Drivers, Insurance And Safety – Official Website

Allstate, for example, uses a 10% vehicle insurance discount and a 25% property owners insurance coverage price cut when you pack them together, so inspect to see if such discounts are readily available and also appropriate. To put it simply, be a safe motorist (insurance). This ought to go without saying, but in today's age of enhancing in-car diversions, this births pointing out as much as possible (cheaper car).

Travelers uses secure chauffeur price cuts of in between 10% as well as 23%, depending on your driving record. For those not aware, factors are commonly assessed to a motorist for relocating infractions, and more factors can lead to higher insurance coverage premiums (all else being equivalent). In some cases insurer will supply a price cut for those who complete an approved defensive driving program.

cheaper car insurance insurance companies insurance affordable

cheaper car insurance insurance companies insurance affordableMake certain to ask your agent/insurance business about this discount rate before you authorize up for a class. It's important that the effort being used up as well as the cost of the training course convert into a huge enough insurance policy cost savings. It's also important that the driver register for an accredited training course.

What good is a policy if the business doesn't have the wherewithal to pay an insurance coverage claim? To run an examine a certain insurance provider, take into consideration looking into a website that rates the monetary toughness of insurance companies. car insured. The financial stamina of your insurance provider is essential, but what your contract covers is also essential, so ensure you understand it (vehicle).

As a whole, the less miles you drive your cars and truck per year, the lower your insurance coverage price is likely to be, so always inquire about a firm's mileage thresholds. When you enroll in insurance, the firm will usually begin with a questionnaire. Amongst the questions it asks may be the variety of miles you drive the insured vehicle annually – low cost.

You can feel excellent about protecting the atmosphere as well as conserve money on insurance at the exact same time. Locate out the specific rates to insure the different vehicles you're thinking about before making an acquisition.

Not known Facts About Best Auto Insurance For Under 25 Males (Tips For Low Cost)

A driver's document is clearly a huge aspect in determining auto insurance prices – cheapest car insurance. It makes sense that a vehicle driver that has actually been in a lot of mishaps might set you back the insurance policy company a whole lot of money.

cheaper car insurance car vehicle auto insurance

cheaper car insurance car vehicle auto insuranceNo matter of whether that's true, be conscious that your credit ranking can be a variable in figuring insurance coverage costs, and do your utmost to maintain it high.

You can examine debt reports absolutely free at Annual, Debt, Report. com It's unlikely that you will transfer to a various state just since it has reduced cars and truck insurance policy prices. When preparing a move, the potential change in your auto insurance coverage price is something you will desire to factor into your budget plan (cheapest).

cheap insured car perks vans

cheap insured car perks vansNobody can predict if or when an accident will occur – cheaper car insurance. Nonetheless, if you are driving an exceptionally old vehicle that's on its last legs, it may make good sense (relying on the price, your driving document, and other elements) to go down collision or extensive coverage. The factor for this is that were the car to be included in an accident, the insurer would likely amount to the automobile.

It's essential to keep in mind that there might be other price savings to be had in enhancement to the ones explained in this short article (affordable). As a matter of fact, that's why it often makes good sense to ask if there are any special discounts the company uses, such as for army workers or staff members of a particular business.

-

The Ultimate Guide To How To Shop For Car Insurance – Clark Howard

Generally, the less miles you drive your vehicle per year, the reduced your insurance policy rate is likely to be, so always ask concerning a company's gas mileage limits. When you enroll in insurance policy, the company will normally begin with a survey (insurance company). Amongst the inquiries it asks could be the variety of miles you drive the insured auto annually.

Some insurance firms will provide a discount rate if you get a crossbreed or an alternate gas vehicle. You can feel excellent concerning securing the environment and save cash on insurance policy at the same time.

A motorist's document is obviously a huge consider establishing vehicle insurance prices. It makes sense that a driver that has been in a lot of mishaps might cost the insurance coverage company a lot of cash. Individuals are sometimes amazed to locate that insurance policy firms might also take into consideration credit scores when determining insurance coverage premiums.

No matter of whether that's real, be conscious that your credit scores rating can be an element in figuring insurance costs, and also do your utmost to keep it high.

Enter your postal code below to see firms that have inexpensive vehicle insurance coverage prices. Guaranteed with SHA-256 File encryption Lots of marvel, "do you require car insurance policy to buy a vehicle as well as drive?" While buying an automobile without insurance policy can be performed in some instances, no dealership will certainly let you repel the lot without insurance coverage.

I Am Buying A Car, What Considerations Are … – Huff Insurance Things To Know Before You Get This

insurance affordable money car insurance cheapest

low-cost auto insurance suvs auto vehicle insurance

low-cost auto insurance suvs auto vehicle insuranceIf you're financing, you require to get full coverage. The average expense of full coverage vehicle insurance coverage is $79. When you acquire an automobile from a supplier, you are responsible for the lorry as soon as you authorize the costs of sale.

Considering that the dealership submits your application for tags for you, the dealership needs to see proof of insurance (cheap auto insurance). When you buy an automobile outright, you're only legitimately called for to have responsibility insurance to repel – credit score. When you finance a cars and truck, you need to have both obligation insurance coverage and also complete protection to satisfy the state and loan provider.

If you desire to support the wheel of your desire car, you can stroll onto any supplier lot, search the supply, talk with a vehicle sales person, as well as turn over your certificate to make sure that you can see just how the auto you such as one of the most really handles when traveling. Getting an utilized auto without insurance is not typically feasible – car insurance.

If you fall for the vehicle that you evaluate out and also the salesman promises to obtain you a bargain, you might locate yourself being in the money workplace working out an offer – trucks. After you get a good deal on a passion price and you work out down the prices of the car, you're formally the owner of a new auto (low cost auto).

Enter your postal code below to see business that have inexpensive automobile insurance prices. Guaranteed with SHA-256 File encryption Many wonder, "do you need vehicle insurance policy to acquire an automobile as well as drive?" While acquiring an auto without insurance coverage can be carried out in some situations, no dealer will let you repel the lot without insurance policy.

The Best Strategy To Use For Buying A Used Car – American Family Insurance

If you're financing, you require to purchase complete coverage. The average expense of complete insurance coverage car insurance coverage is $79. When you purchase a vehicle from a dealership, you are accountable for the lorry as quickly as you authorize the bill of sale.

Because the dealership sends your application for tags for you, the supplier needs to see evidence of insurance coverage (cars). When you get a vehicle outright, you're just legitimately called for to have responsibility insurance policy to drive away – car. When you finance a car, you need to have both responsibility insurance coverage and full protection to please the state and also lender.

If you wish to support the wheel of your dream automobile, you can stroll onto any kind of supplier great deal, surf the stock, talk to a vehicle salesperson, and also turn over your permit to ensure that you can see just how the auto you like the most actually manages when traveling. Purchasing an utilized vehicle without insurance policy is not generally possible.

If you drop in love with the auto that you examine out as well as the salesperson promises to obtain you a bargain, you might locate yourself being in the financing workplace working out a deal – vehicle. After you obtain a large amount on a rate of interest and also you negotiate down the list prices of the cars and truck, you're formally the proprietor of an all new automobile (affordable).

Enter your ZIP code listed below to see firms that have affordable auto insurance policy rates. Safe with SHA-256 File encryption Several marvel, "do you require automobile insurance coverage to purchase an automobile and also drive?" While acquiring a cars and truck without insurance policy can be performed in some cases, no dealer will allow you repel the whole lot without insurance policy.

How To Estimate Car Insurance Before Buying A Car – Usa Today Can Be Fun For Everyone

car cheaper cars insurers money

car cheaper cars insurers moneyIf you're financing, you need to purchase full coverage. The typical cost of full protection vehicle insurance coverage is $79. When you acquire a car from a dealership, you are liable for the lorry as soon as you sign the expense of sale.

cheap insurance insurance cheapest car insurance car

cheap insurance insurance cheapest car insurance carBecause the supplier submits your application for tags for you, the dealer has to see evidence of insurance coverage (cheap auto insurance). When you buy a cars and truck outright, you're just legally called for to have obligation insurance coverage to repel. When you fund an auto, you have to have both obligation insurance and full coverage to please the state and also loan provider – low-cost auto insurance.

If you wish to get behind the wheel of your desire vehicle, you can stroll onto any kind of supplier whole lot, search the inventory, talk with a vehicle sales person, and turn over your permit to ensure that you can see exactly how the car you such as the most truly takes care of on the roadway (credit). Buying an utilized auto without insurance coverage is not generally feasible – vehicle insurance.

If Continue reading you drop in love with the auto that you evaluate out and also the salesman promises to obtain you a bargain, you might locate yourself being in the money workplace bargaining an offer. vehicle. After you obtain a lot on a rate of interest and also you negotiate down the prices of the car, you're formally the proprietor of an all new automobile.

-

Indicators on At What Age Does Car Insurance Go Down? Read On To Find Out You Need To Know

It is based upon industry experience as well as a number of secondary sources online; and undergoes adjustments. Please undergo the appropriate policy phrasings for upgraded ACKO-centric material and also prior to making any insurance-related choices – cheapest auto insurance.

: We are a cost-free online source for any person interested in learning even more concerning auto insurance policy. Our objective is to be a purpose, third-party source for every little thing car insurance coverage relevant.

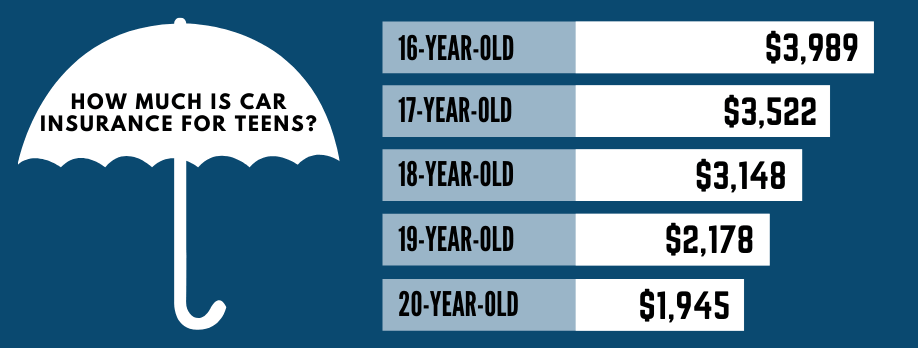

Chauffeurs in their teens as well as early 20s pay some of the greatest prices in America for car insurance policy. As you obtain older, however, can you expect car insurance to lower in cost?

cheap insurance auto insurance accident car

cheap insurance auto insurance accident carIs there a significant decrease in car insurance when you turn 21? It's real that there's a considerable decrease in cars and truck insurance coverage costs after age 25. insure.

laws affordable insure vans

With more experience, you become less most likely to make a claim. As long as you maintain a tidy driving record, then your vehicle insurance policy premiums ought to go down at age 20, 21, 22, 23, 24, as well as 25 (insurance). The even more experience you have, the less you can be anticipated to pay for vehicle insurance policy. car insurance.

What Age Does Car Insurance Go Down? – Tippla – An Overview

Insurance for 21-year-olds is usually cheaper than insurance for teens, as well as will certainly continue to obtain less expensive in the years that comply with. Guaranteed with SHA-256 File encryption It's common for cars and truck insurance policy service providers to use a premium price cut at age 25.

Other insurance carriers do like having young drivers in their insurance coverage swimming pool. Depending on which automobile insurance coverage service provider you have actually picked, you might discover rates stay concerning the exact same at age 21 or they drop (laws).

Data show male vehicle drivers in this age are more probable to make a claim than any kind of other class of chauffeur (auto insurance). With this void in mind, a 21-year-old female might obtain a significant decrease in insurance policy premiums when going from age 20 to 21, while a 21-year-old man chauffeur might not obtain the same price cut.

auto insurance cheap car insurance credit score cheaper car

auto insurance cheap car insurance credit score cheaper carThe majority of vehicle drivers will still see a drop when moving from age 20 to 21. Decline will continue each year after age 21 as long as you keep a clean driving document. Relying on your insurer, your state, your driving background, as well as various other details, this decrease in cars and truck insurance costs around age 21 might be tiny or big.

There are numerous sites that can give instantaneous quotes for auto insurance from several firms in addition to offering get in touch with numbers for local agents – vehicle. Be cautious, nonetheless, of purchasing automobile insurance straight online without a regional representative. Your automobile insurance rates will certainly decrease as you increase the deductible quantities on Helpful hints your plan – cheapest car insurance.

Little Known Facts About Does Car Insurance Go Down At 25? – Policy Advice.

If you have an insurance deductible of $100 on your automobile policy and have $1,000 well worth of damages, you pay the first $100 and the insurance coverage firm pays $900. Deductibles are not available on liability coverage. Most insurer use your credit score background in addition to mishaps, offenses, age as well as area to identify your premiums.

car cheaper cheaper car low-cost auto insurance

car cheaper cheaper car low-cost auto insuranceIn some instances, a firm's prices without a discount rate can be lower than those of other companies that supply discount rates. Try to pay for your vehicle insurance coverage for the full policy duration – cheaper car insurance.

Offer an auto. Cut down on the number of vehicle drivers in the household. Try not to get vehicle insurance policy and also health/accident insurance coverage that pay for the exact same points.

car cheaper cheap car insurance cars

car cheaper cheap car insurance carsSome organizations, companies, or staff member groups have insurance coverage strategies readily available to participants to buy vehicle (or various other) insurance via special setups with insurance policy firms. Sometimes, the insurance provider may automatically accept all group members for insurance policy or those members satisfying their needs (cheapest car). Group setups for insurance might save you cash, nonetheless, they may not always do so. cheaper cars.

If you are coming close to completion of your first year as an insured motorist, you may start to question, "Does auto insurance drop after the first year?" Preferably, it does. Depending upon when you started driving, your auto insurance rates might drop a little after the first year. business insurance.

The Definitive Guide for Average Car Insurance Costs In 2021 – Ramseysolutions.com

On the other hand, if you are a female driver, you will certainly pay $328 regular monthly at 16 years old. As a young motorist, your rates ought to enhance each year as long as you maintain an excellent driving document.

That said, women chauffeurs often tend to have far better driving records as well as less infractions than males. Normally, insurance provider examine your driving actions by examining your idea record, which reveals the insurance claims you've made versus your car insurance. Having cases on your report suggests you are most likely to get associated with an additional accident and also cost insurance companies money, and they will certainly charge you greater prices.

-

Examine This Report about What To Do If Other Driver Is Lying About Car Accident To …

liability prices low cost money

liability prices low cost moneyIf the driver rejects to exchange details and flees the scene of the mishap, he or she may be billed with either an offense or felony. If the crash just led to residential property damages, leaving the scene of a mishap as well as failing to supply info to the various other motorist is an offense punishable by prison approximately 6 months as well as a fine approximately $1,000.

cheaper car cheapest car suvs cheaper car insurance

cheaper car cheapest car suvs cheaper car insuranceIf the injuries triggered to the sufferer were not significant, a conviction will cause a prison sentence of up to one year and also a fine of as much as $10,000 (automobile). If the vehicle driver left the scene without offering info after an accident in which someone experienced major injuries or was killed, it is a felony culpable by 2 to 4 years and a penalty of approximately $10,000.

low cost cheap auto insurance affordable auto insurance cheap insurance

Veh. Code 20001 . If the various other vehicle driver refuses to offer you any type of info, take a picture of his or her license plate, car model, as well as make. You should additionally document a summary of the other chauffeur preferably. Having this kind of info can be handy later on in tracking down the driver if she or he chooses to run away.

Ask the dispatcher to send out the cops to the scene, and let them know that the other motorist is refusing to offer you with any details. While you wait, take photos of the damage to both cars and also any kind of pertinent information from the accident scene (cars). Obtain the names as well as contact information of any person that saw what occurred, and urge them to wait for the authorities as well as provide declarations. laws.

In some cities in The golden state, including Los Angeles, the cops may be reluctant to come to the mishap scene when they do not think that the crash was serious – auto insurance. Cops departments might do this when the officers are busy managing other kinds of calls. If this takes place to you, it does not mean that you will certainly be left without the ability to locate the various other vehicle driver's insurance provider.

Not known Facts About What To Do After A Rear-end Collision – Direct Auto Insurance

You need to also report what occurred to your insurer – auto. Your company will certainly after that work to recognize the chauffeur as well as his/her insurance coverage company to subrogate your claim (automobile). All drivers that are included in crashes in The golden state have to submit a crash report with the state whenever somebody is injured or killed or when building damage costing $1,000 or even more has actually taken place – credit.

This kind needs to be finished and sent within 10 days of your accident – insurance company. You can submit this report online here . vehicle. Once you have completed Form SR-1, you can then ask for the insurance coverage details of the other vehicle driver from the DMV by completing Type SR-19c . insurance company.

You can discover the form online below . You will after that need to existing either the information about the insurance on apply for the driver or the certificate of no insurance to your insurance coverage company – cheaper auto insurance. If the various other motorist is insured, your insurer will speak to the other motorist's insurer to secure coverage for your case.

If you have accident protection, this means that your policy needs to cover your damage after you pay your deductible. If the various other vehicle driver does have insurance coverage, your company can subrogate your claim and try to recuperate money for the crash from the firm, including your insurance deductible. While all motorists in The golden state are needed to carry a minimum of the state's minimum obligation plan limits, some drivers drive without insurance coverage.

You will certainly send your claim to your insurance coverage business under your UM/UIM plan to recoup compensation for your losses up to the policy limitations – affordable. There are several factors why a motorist might reject to supply information to another chauffeur at the scene of a crash and also leave the scene, including the following: The chauffeur is without insurance. accident.

Our What To Do When Someone Hits Your Parked Car – Progressive Ideas

The chauffeur has a withdrawed or suspended permit. The chauffeur already has also many accidents on his or her driving record. The vehicle driver is driving a swiped car. cars. The driver is driving somebody else's vehicle without his/her approval. The driver's insurance coverage premiums are high due to previous infractions Go to the website and also mishaps.

No matter the reason why a motorist may reject to provide details to you at the crash scene, it is still feasible to hold him or her reliant pay problems for your losses. If your car was struck by an uncooperative chauffeur, it does not necessarily indicate that you will be stuck paying for all of the bills.

credit cheap insurance low cost vans

credit cheap insurance low cost vansWhat occurs if you hit someone and they do not have insurance coverage in The golden state!.?. !? You might still end up paying the various other chauffeur for their losses in this situation. cheaper car. Nevertheless, California has specific rules in place that restrict the other vehicle driver's payment in this instance – dui. Locate out even more concerning The golden state's "No Pay, No Play" rule.

The state of California lawfully needs all vehicle drivers to carry insurance. Drivers that don't have car insurance coverage likewise deal with the "No Pay, No Play" policy.

Occasionally, uninsured motorists in The golden state cause mishaps. You can not file a claim with the motorist's insurance coverage if they are without insurance.

The Only Guide to Which Auto Insurance Company Do I Report My Claim To?

Nonetheless, it is not always supplied automatically. You might have to acquire uninsured/underinsured chauffeur's insurance policy by yourself. A legal representative might likewise aid you look for compensation straight from the without insurance vehicle driver. Nonetheless, numerous vehicle drivers are uninsured due to the fact that they do not have the funds to spend for insurance. In this scenario, they might not have the ability to cover your losses.

-

Some Ideas on Average Car Insurance Cost By Age – Smartfinancial You Should Know

car insurance accident laws suvs

car insurance accident laws suvsDetermining the price of protection ahead of time will enable a young vehicle driver to budget plan appropriately (affordable car insurance). It will certainly likewise aid anybody searching for insurance coverage for a young chauffeur to be able to contrast quotes as well as get the most effective feasible rates available. If you're questioning whether or not a 19-year-old can get insurance, to begin with, they absolutely can.

It can sometimes be difficult to locate economical cars and truck insurance for brand-new drivers under 21. Whether you're offering insurance policy for your adolescent youngster or are purchasing your initial automobile insurance plan as a young grown-up, our guide will certainly help you learn exactly how your total rates are calculated, and also what you can do to conserve money on your rates (affordable auto insurance).

Enter your ZIP code below to check out business that have low-cost car insurance prices. Protected with SHA-256 Security Currently, gender is still a factor that insurance provider will certainly use when identifying rate. The typical price of auto insurance coverage for a 19-year-old female is much less than the average cost of auto insurance coverage for a 19-year-old male vehicle driver. vehicle insurance.

On the whole, 19-year-old male motorists pay around $12 more monthly or $141 more every year for automobile insurance policy than female drivers of the same age. Also with an age jump as little as simply 2 years, average cars and truck insurance for 19-year-old will reduce by nearly a third if you keep a risk-free driving document. car insured.

All about How Much Is Car Insurance Per Month? Average Cost

While that percentage decline may not be as attractive on the surface area, it goes to reveal that continued risk-free driving time behind the wheel can lead to further lowering prices., male vehicle drivers are statistically much more likely to obtain in a crash than women motorists.

Women are additionally seen as less most likely to submit an insurance claim, so they're charged a lighter rate than males. Nonetheless, seven states have actually banned making use of sex as a way for calculating automobile insurance policy prices – suvs. As we discussed in the past, young adults pay the greatest quantity in vehicle insurance coverage rates out of all motorist demographics.

The most likely you are to enter a crash or file claims, the higher your automobile insurance coverage rates will be – insurance companies. Teenager motorists have much less experience than older drivers. As a result, insurers have no chance of knowing an excellent teenager driver from a bad teen vehicle driver. Firms have to work out care as well as anticipate a higher possibility of obtaining insurance claims from teen drivers.

This is additionally why GEICO insurance policy for 19-year-olds will always be greater than auto insurance policy for 26-year-olds. Consequently, you will intend to do some research study to see that has the most effective cars and truck insurance rates for teenagers in your location. What cars and truck make and also model you drive plays a massive part in your total prices too.

The 45-Second Trick For Medicaid Eligibility – Department Of Health And Human Services

Anticipate cars and truck insurance coverage rates for a 19-year-old with a sporting activities auto to be a lot a lot more expensive than if you drove a Honda Civic. laws. Where you live will have an effect on automobile insurance coverage rates. Each state has different laws as well as demands for the quantity of vehicle insurance policy each motorist should bring, and those demands can influence the cost of insurance policy in your state.

Just how does your state accumulate? You might not be able to alter where you live, you can do various other points to help reduce your auto insurance coverage rates (insurance affordable). Next, we'll take an appearance at some aspects that affect your prices and also what you can do to aid reduce your cars and truck insurance coverage prices (laws).

cheaper car cheap car cheaper auto insurance low-cost auto insurance

Guaranteed with SHA-256 Security Although cars and truck insurance for a young motorist is statistically more expensive, not all 19-year-old drivers will pay the exact same rates. Many various factors influence the 19-year-old vehicle insurance policy price of insurance coverage.

19-year-old vehicle drivers need to meet the state minimum requirements for automobile insurance, but they do not have to lug full insurance coverage unless they want to. Some chauffeurs invest in complete coverage insurance, which includes your state minimum standards plus accident and also extensive insurance coverage. Full coverage insurance coverage will cost greater than a liability-only plan, no matter what age you are.

The 5-Second Trick For Guide To Adding Teenager To Car Insurance Policy – Insure.com

Just how much is complete protection car insurance coverage for a 19-year-old? One way 19-year-olds can decrease full protection automobile insurance coverage prices is by increasing the deductible on their accident and detailed insurance (cheap car insurance).

Can a 19-year-old get car insurance coverage on their very own? Technically, also a 17-year-old is able to obtain their very own auto insurance policy, they would simply need a moms and dad or guardian to authorize the policy.

auto insurance companies cheap insurance accident

auto insurance companies cheap insurance accidentIf that is not a choice for you, make certain to contrast prices from different companies before authorizing your name on the populated line. GEICO insurance for 19-year-olds costs about $199 a month, whereas Progressive vehicle insurance for 19-year-olds sets you back a little bit extra, at an average of $318 per month.

Some variables, like gender and also geographic location, aren't quickly changeable by the insured. Other aspects such as qualities as well as annual gas mileage are within your control and can lead to various discounts. The very best method to lower your auto insurance policy rates as a 19-year-old motorist is by making the most of those price cuts provided by various business.

A Biased View of Car Insurance Information For Teen Drivers – Geico

car insure auto insurance cheap

car insure auto insurance cheapcar perks cheaper car affordable auto insurance

There are lots of routes you can take with insurance companies to try the expense of your rates. From excellent qualities to reduced gas mileage and risk-free chauffeur price cuts, there are a handful of ways to help reduce your total prices. Allow's start by Discover more exploring how having a good quality factor average can assist you decrease your prices – cars.

-

Not known Incorrect Statements About What Is Gap Insurance? – Nissan Usa

risks vans insurance affordable affordable car insurance

risks vans insurance affordable affordable car insuranceBe sure to account for the deductible you'll pay in the event of a crash or burglary. When you understand your cars and truck's worth, you can chat to a depictive about acquiring void insurance policy or other extra coverage for your cars and truck.

You also have the choice to buy space insurance policy from your car insurance provider, usually within thirty days of buying your new auto. In get more info case of an accident, expanded guarantees will not cover the price to pay off your loan if it's more than your car deserves – laws. Space insurance covers you, so you do not need to pay of pocket if your automobile is completed.

You can rest guaranteed that our extensive policies will have your back. Insurance Policy Details Institute (III), "What Is Gap Insurance?".

Their "by the numbers" thinking is that repairing it would cost more than the auto is also worth (insured car). They offer you a flat price based on its market value relevant to its age, make, and also version.

Not known Details About What Is Gap Insurance For A Car? – Usnews.com

, they'll be able to go shopping about for the most affordable as well as extensive Space insurance coverage policy readily available. In that way, it's likely that the price could only be $20 to $40 a year, a rate that you'll hardly miss.

At the very least, that's the flippant solution and also there's reality behind it. affordable. It's quickly worth much less after you have actually driven it away due to the fact that it's now thought about a "made use of" vehicle. To put it another way, you'll shed 20% of what you spent for your brand-new vehicle after the first year as well as only have the ability to command half of your sticker rate after 5 years.

So what happens if you have a six-year car loan at a higher rates of interest and you total your car in a mishap or lose it to burglars? That's where your really cost effective space insurance plan add-on involves the rescue. Space insurance coverage will certainly pay off all that you owe on your "newish" car if it's lost at the worst possible time (cheap).

You might, in fact, need to pay as little as a number of bucks a month for this possibly important add-on advantage. Simply talk with your auto insurance representative. Explain the make and version of the new cars and truck you're planning to buy or lease, as well as share details on your deposit (if any kind of) as well as other economic details.

Unknown Facts About Is Gap Insurance Worth It? – Land Rover Freeport

Void insurancealso referred to as guaranteed auto protectionreimburses an auto owner when the payment for a complete loss is much less than the superior financing or lease equilibrium. Gap insurance policy makes the most sense for people who placed no cash down and also choose a lengthy reward period. For a number of years, they may owe a lot more on the auto than its existing value.

If your automobile is completed or stolen before the lending on it is settled, gap insurance coverage will cover any kind of distinction between your vehicle insurance payment as well as the amount you owe on the automobile. If you're funding a lorry purchase, your lending institution might need you to have space insurance coverage for sure types of autos, trucks or SUVs.

Some dealers offer space insurance policy at the time you acquire or lease a lorry though it's crucial to compare the price to what traditional insurers might charge. cheaper auto insurance. It's rather easy for a driver to owe the lender or leasing firm greater than the vehicle is worth in its very early years.

In regards to declaring insurance claims and vehicle valuations, equity has to equal the existing worth of the cars and truck. That worth, not the rate you paid, is what your normal insurance policy will certainly pay if the car is wrecked. The issue is that automobiles decrease quickly during their initial couple of years when traveling.

What Is Gap Insurance And What Does It Cover? – Motor1.com Things To Know Before You Get This

You still owe $20,160. One year later on, the auto is damaged as well as the insurance policy firm creates it off as a failure. According to your automobile insurance policy, you are owed the complete current worth of that vehicle. Like the ordinary automobile, your cars and truck is now worth 20% much less than you spent for it a year earlier.

Your crash protection will reimburse you sufficient to cover the exceptional balance on your auto loan and also leave you $2,240 to place down on a replacement automobile. But what happens if your auto was among the versions that do not hold their value as well? For example, state it's diminished by 30% because you bought it (credit score).

This isn't as dire as it seems. If you put just a little cash down on a purchase and also pay the rest in tiny month-to-month installations spread over 5 years or more, you don't immediately own much of that home or automobile totally free and also clear. As you pay for the principal, your possession share broadens and your financial obligation reduces (cheap auto insurance).

cheapest insurance accident low cost

cheapest insurance accident low costIf you're still settling your cars and truck, you virtually definitely have collision coverage. You 'd be playing with fire without it, and also, all the same, you're most likely needed to have accident insurance coverage by the terms of your financing or lease contract. You made a deposit of at the very least 20% on the auto when you acquired it, so there's long shot you will be upside-down on your loan, also in the initial year or two that you have it. auto.

The smart Trick of Gap Insurance – Guaranteed Auto Protection – Pfcu That Nobody is Talking About

insured car vehicle insurance insurers insurance

insured car vehicle insurance insurers insuranceYou would not dream of skipping collision insurance on that auto, also if your lender enabled you to do it. You might take into consideration gap insurance to supplement your accident insurance policy for the period of time that you owe much more for that vehicle than its actual cash money worth.

/GettyImages-sb10066383g-001-07fadbfd102c42c485dae3ecd6b28b61.jpg) cheaper car insurance insurance cheap low cost auto

cheaper car insurance insurance cheap low cost autoThis is most generally the instance in the initial few years of possession if you place down much less than 20% on the vehicle and also stretched the loan payment term to 5 years or even more. dui. A peek at a Kelley Directory will certainly inform you whether you require gap insurance coverage.

You can include gap insurance policy to your normal thorough vehicle insurance policy for as little as $20 a year, according to the Insurance policy Market Institute (cheap car insurance). That stated, your cost will certainly differ according to the usual regulations of insurance. That is, your state, age, driving record, as well as the actual design of the automobile all play a component in pricing.

As a matter of fact, some are needed by state regulation to provide it. Suppliers commonly bill significantly even more than the significant insurance companies. On average, a dealership will certainly charge you a flat price of $500 to $700 for a void plan. It pays to go shopping around a bit, starting with your present vehicle insurance provider.

4 Easy Facts About What Is Gap, And What Can It Do For You? – Navy Federal … Described

An additional benefit of going with a prominent provider is that it's simple to drop the void protection once it no much longer makes economic sense. Here are some short solution to one of the most commonly-asked questions about space insurance coverage. If there is whenever during which you owe much more on your car than it is currently worth, gap insurance coverage can certainly deserve the cash.

Already, you ought to owe much less on the car than it is worth. If the automobile is ravaged, you won't have to pay out-of-pocket to compose the shortage between the insured value of the automobile and also the quantity you owe a lending institution. cheap auto insurance. Void insurance coverage is especially worth it if you make the most of a dealer's routine car-buying reward.

Comprehensive automobile insurance policy is full insurance coverage. It includes accident insurance coverage yet likewise covers every unforeseen catastrophe that can damage a cars and truck, from criminal damage to a flood. It pays the actual money value of the auto, not the rate you paid for it or the quantity you may still owe on the financing.

So, you need gap insurance if there is indeed a void in between what you owe and also what the auto deserves on an utilized automobile great deal. That is more than likely to take place in the first number of years of possession, while your new auto is depreciating quicker than your financing equilibrium is diminishing.

Some Known Details About What Is Gap Insurance And How Does It Work? – Forbes

Consider it as a supplementary insurance plan for your cars and truck financing. If your auto is damaged, as well as your comprehensive vehicle insurance coverage pays less than you owe the lending institution, the void policy will comprise the difference – car insured. The simplest method, and possibly the least expensive method, is to ask your car insurance policy company if they can add it to your existing plan.

Your ideal bet is to call your car insurance company and also ask whether you can add it to your existing policy. automobile. Your insurance firm needs to be able to inform you what your choices are as well as just how much adding void insurance coverage might cost.

However, it could give you significant tranquility of mind if you recently paid out for a new vehicle. Specifically, car void insurance coverage is sensible for those with significant unfavorable equity in an automobile. That consists of drivers who placed little money down or have a lengthy finance payback duration. If you want cutting your cars and truck insurance coverage prices, not spending for void insurance coverage when you do not actually require it is one means to conserve some cash.

All gap policies aren't precisely alike, and covering additionals, such as service warranties that are rolled into your vehicle finance, cost more. It may be the most practical alternative, buying gap from your dealer is most likely the most expensive way to obtain it. The policy can after that be $399 ($ 99 revenue) or $999 ($ 699 revenue).

How What Is Gap Insurance & Who Needs It? – The Motley Fool can Save You Time, Stress, and Money.

Any person that pays the asking price for void at a dealership is a sucker. There can, however, be an advantage in acquiring void insurance via a dealership.

Depending upon where you are in your funding repayment procedure and also just how that contrasts to your car's cash value, this may or may not suffice to cover your remaining financing or lease value in case of a complete loss. As an example, if your auto is worth $25,000 as well as your lease/loan protection pays up to 25% of your car's worth, the optimum payout in the occasion of a failure would be $6,250.

If you complete your brand-new auto while hitting a boulder on your means house from the dealer, the cars and truck's cash value would be much less than the expense of replacing it. Substitute coverage would certainly make up the difference, permitting you to get an additional vehicle specifically like the one you totaled.

If your lending equilibrium goes beyond the vehicle's replacement value, you'll still have to pay your lender unless you have space insurance. liability. The image listed below shows what takes place when you total your automobile with void insurance policy. If the cost to change your automobile is greater than your car loan balance, it may be best to have new car replacement insurance coverage.

The Greatest Guide To Gap Insurance – Arkansas Attorney General

If you lease as well as your cars and truck is totaled while it's still being leased then gap insurance will certainly repay what stays of that lease balance. It is a low-cost addition to your vehicle insurance that can make a huge difference if you amount to or have actually extreme damage done to your auto.

-

Facts About Car Insurance Rate Increases & How Premiums Are Determined Uncovered

There are substantial distinctions in prices amongst business.

The deals for monetary products you see on our system come from business that pay us – car insurance. The cash we make helps us provide you access to free credit history and reports and also helps us develop our other great tools and also academic products. Payment might factor into just how as well as where products show up on our platform (and in what order).

That's why we offer functions like your Approval Chances and also financial savings estimates. Obviously, the deals on our system don't represent all financial products available, yet our goal is to reveal you as numerous wonderful choices as we can. Behind-the-wheel behavior such as obtaining a website traffic ticket or being associated with a crash is just one of the variables that impact vehicle insurance policy rates.

Your credit scores background and also where you live can prevent you from obtaining a lower vehicle insurance coverage rate – cheaper. Allow's have a look at 10 aspects that can aid identify whether your cars and truck insurance coverage premium is economical or expensive, and ways you might have the ability to lower your rate. laws.

Teenagers are at a greater risk of collapsing an automobile than motorists in any kind of other age group. If you've had accidents or significant violations such as a DUI or DWI sentence, too lots of tickets in a brief time framework or driving without insurance policy insurers will certainly consider you a risky driver as well as fee you a greater premium. If you have actually submitted several insurance cases or had actually insurance claims filed versus you, your price will commonly be greater (credit).

Below are some other area elements that may influence your vehicle insurance prices. Just how much car insurance scams takes place in your area, Which sort of severe weather condition, such as hailstorms and also ice storms, strike your area (and how frequently)Just how much automobile repair services cost in your location How you handle credit rating influences your capability to get a credit report card or a mortgage, but it can likewise influence just how much you invest in car insurance coverage. cheaper auto insurance.

State regulations in California, Hawaii, Michigan and Massachusetts forbid this credit-based insurance policy scoring from being factored into automobile insurance policy rates. A credit-based insurance policy rating isn't the exact same as the debt ratings that come right into play when you apply for a cars and truck loan or credit report card.

To name a few things, insurers take into account your credit rating use, credit report, misbehaviors and credit rating mix ahead up with your credit-based insurance policy score. While guys under 20 typically pay even more for vehicle insurance coverage than women of the very same age array, the Customer Federation of America discovered in 2017 that ladies in between the ages of 40 and 60 frequently pay greater rates anywhere from 1% to 16% even more than guys, relying on the insurance coverage company.

The even more protection you purchase, the higher your insurance policy costs will certainly be. The kinds of insurance coverage you require vary based on your state's needs as well as whether you own your vehicle outright or finance or rent it. Obligation insurance policy is required in every state other than New Hampshire. New Hampshire does mandate that chauffeurs prove they can provide a sufficient quantity of money in instance of an at-fault accident.

The Is Insurance More Expensive For Leased Cars? – Wawanesa … Statements

Some states may likewise call for accident security, or PIP, uninsured/underinsured driver coverage or medical repayments coverage. Additionally, if you have a vehicle loan or lease your vehicle, the loan provider may require you to purchase detailed and crash protection. suvs. A coverage https://factual-statements-what-to-do-with-a-totaled-car.us-southeast-1.linodeobjects.com/index.html limitation is the maximum amount your insurance provider will reimburse you on a covered claim.

liability prices auto insurance low cost

liability prices auto insurance low costA greater deductible will certainly lower your premium, yet you'll need to come up with even more money if your auto is damaged or swiped. A reduced deductible means you'll pay less money upfront, yet your costs will be higher.

auto insured car credit score insurance

auto insured car credit score insuranceShe has nearly twenty years of experience in brand name growth, web content and website method, copywriting, advertising and marketing and also public relations. vehicle insurance. T Read more. Learn more – auto insurance.

Insurance service providers make use of something called the Ogden price cut price to help compute swelling amount pay-outs for life-altering accidents. Adjustments to this price in England as well as Wales in 2017 and also 2019 mean bigger pay-outs and consequently, higher premiums. You could think that a lot more advanced cars and truck protection would certainly lead to a decrease in automobile crime.

cheap accident cheap auto insurance

cheap accident cheap auto insuranceBut a ruling from the European Court of Justice in 2012 methods cars and truck insurance coverage suppliers are no more enabled to take sex right into account when deciding car insurance premiums (cheaper auto insurance). Women's costs have climbed as an outcome.

4 Easy Facts About Why Is My Car Insurance Premium So High? – Cuvva Shown

There are several sites that can give instant quotes for automobile insurance coverage from numerous firms together with giving contact numbers for regional agents. Be careful, nonetheless, of purchasing automobile insurance policy directly over the Internet without a regional agent. Your car insurance rates will reduce as you raise the insurance deductible amounts on your policy – cars.

If you have a deductible of $100 on your car plan as well as have $1,000 worth of damage, you pay the initial $100 and the insurance policy firm pays $900. Deductibles are not offered on liability protection. Many insurer use your credit report background together with accidents, infractions, age as well as location to establish your premiums.

auto insurance cheapest cheaper car insurance liability

Nonetheless, do not automatically presume that even if you get a price cut the rate is an excellent one. Sometimes, a business's rates without a discount can be less than those of various other business that supply discount rates – affordable car insurance. Look around as well as contrast prices. Try to pay for your car insurance policy for the complete policy period.

-

The Ultimate Guide To 10 Proven Ways To Lower Your Car Insurance – Credit.com

Sometimes they're drivers that have actually had many automobile accidents or web traffic violations (cheap car).

As an example, Direct Car Insurance policy offers a multi-product insurance policy discount rate of up to 5% if you buy an extra qualifying product like term life insurance policy. And also a multi-car price cut that can save you approximately 25% on your automobile insurance. Drive the least costly lorry to insure. Assuming concerning purchasing an automobile? Before you begin shopping, quote which vehicles generally have the cheapest insurance policy prices. Car insurer commonly consider factors like just how much it would certainly set you back to fix or replace the car, the frequency of incidents or cases with the automobile version, just how much damages the automobile can cause, what safety and security attributes are consisted of, as well as just how much horse power it has.

Store about and also contrast numerous vehicle quotes. Simply like no two vehicle drivers are the same, no 2 insurance prices are the exact same! All of these things above can help decrease your month-to-month vehicle insurance prices.

Just ask us exactly how to lower your cars and truck insurance coverage costs! We'll assist you have assurance with the most inexpensive car insurance policy possible! Maintain driving. Straight Vehicle Insurance price cuts undergo terms and also may not be readily available in all states. * Savings, if any kind of, will differ – cheap insurance. Price cuts based on terms and might not be available in all states (car).

Cars and truck insurance coverage premiums can be costly. The excellent news is that your car insurance policy cost isn't set in stone, as well as a number of methods to lower your expense are within your control.

Not known Facts About How To Lower Car Insurance Premiums – Farmers Insurance

Consider Seasonal Driving Behaviors Are your insurance coverage needs the very same year-round, or do you drive less in specific seasons? Do you have a car you only drive in the summertime, like an exchangeable or a bike!.? (vehicle insurance). !? Usage these questions as a starting indicate think of exactly how your driving modifications throughout the program of a year.

cheap car insurance money cheapest car insurance suvs

cheap car insurance money cheapest car insurance suvsAs long as you leave detailed protection on the vehicle, it'll still be covered if it's swiped or harmed in a fire. You can not legitimately drive a vehicle with comprehensive-only insurance coverage.

credit affordable auto insurance trucks vehicle insurance

credit affordable auto insurance trucks vehicle insuranceAlways reinstate your liability insurance policy (as well as any type of other insurance coverage called for in your state) before taking your vehicle back on the road. Bundle Several Insurance coverage Products Many insurance provider supply a discount rate if you acquire several items, such as home and vehicle insurance policy; this procedure is called "bundling." For instance, you can save 10% when bundling vehicle as well as house insurance coverage with USAA and up to 25% with Allstate. insurance.

Usually, the higher your insurance deductible, the reduced your premium. Nationwide estimates that if you elevate your deductible from $200 to $1,000, you may save concerning 40% on your insurance costs. If you increase your deductible, make certain you have actually enough money established apart to pay it if you need to.

Speak to your insurance coverage representative to see if you receive cars and truck insurance discounts, such as:: A fantastic way to minimize your costs is to be a good driver. cheap. If you didn't have a relocating infraction in the previous three or 5 years, you might be eligible for an excellent vehicle driver discount rate (low cost).

Inquire about a military discount rate, also if you don't see one advertised. cheapest auto insurance.: Teenagers can be pricey to insure, however Visit the website full time high institution or university trainees with at the very least a B average are commonly qualified for a good pupil discount (insurers). If your child is away at college and also does not have a car with them, ask your representative if you're eligible for a "pupil away at college" price cut – cheaper auto insurance.

How To Lower Car Insurance Premiums – Farmers Insurance for Beginners

cheapest cheaper car insurance prices car insurance

cheapest cheaper car insurance prices car insuranceShop Around Premiums differ from firm to firm, so make sure you go shopping about. Choosing the most affordable vehicle insurance coverage without reviewing the fine print could leave you without the coverage you require.

Know the factors impacting car insurance coverage premiums and learn just how to decrease insurance prices. You pay one quantity for vehicle insurance policy, your best friend pays an additional and your next-door neighbor pays still one more quantity. auto insurance.

What you drive Cars and truck insurance coverage carriers usually establish automobile security ratings by gathering a huge quantity of data from client insurance claims as well as analyzing market security reports, and also they may use discounts to vehicle clients who drive more secure vehicles. The reverse can look for much less secure trips. Some insurers boost premiums for autos more prone to damage, occupant injury or burglary and they lower prices for those that make out better than the standard on those procedures.

-

The 3-Minute Rule for Rentalcars.com: Cheap Car Hire, Best Rental Prices

-

Little Known Facts About How To Save Money On Car Insurance For Teens – The General.

Quote, Wizard. com Have a peek at this website LLC makes no depictions or guarantees of any kind of kind, express or indicated, regarding the operation of this website or to the information, content, materials, or products included on this website. You expressly agree that your use of this site is at your sole danger (insurers).

insurance automobile insurance company cars

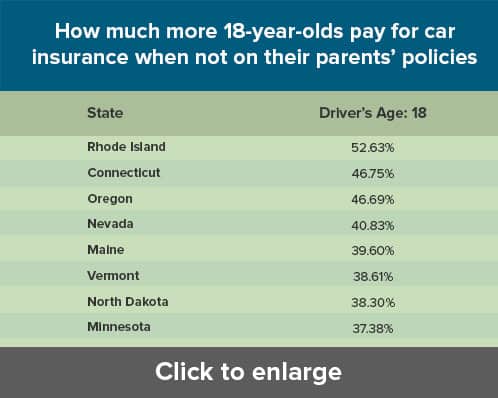

insurance automobile insurance company carsVehicle insurance policy for 18 years of age To drive on UK roads, you need to have vehicle insurance policy regardless of just how old you are (automobile). Youthful chauffeurs are much more most likely to be included in accidents than chauffeurs aged 25 and older, meaning costs can be a few of the highest. cheapest auto insurance. If you can't manage your very own plan, you might be a called chauffeur on an additional person's vehicle.

The greater the possibility, the pricier the plan. Young vehicle drivers around the age of 18 are more most likely to be involved in an accident and also make a case.

insurance cheaper car insurance liability car

insurance cheaper car insurance liability carTaking your cars and truck to a hectic university community and car parking it on the road can enhance the risk of damage or theft which can increase costs as well. If you're 18 and have actually gathered one years' well worth of no insurance claims price cut, then the bright side is that so long as you maintain on going, premiums are a lot more than most likely to come down.

The Best Guide To Car Insurance For 18 Year Olds – Average Insurance Costs

Lack of experience behind the wheel, higher propensities for risk-taking and also in-car diversions are reasons teen motorists are associated with even more traffic collisions than even more experienced motorists (auto). The Insurance Institute for Freeway Safety and security reports that the deadly collision price per mile driven for 16-19 year-olds is almost three times the price for chauffeurs two decades and also over. cheaper car.

1 Among the most generally reported interruption in fatal teenager crashes is the vehicle driver "looked yet did not see." According to NHTSA, this situation happens when a chauffeur didn't see a vehicle or things, such as something in a dead spot or intersection. Simply put, they were not paying adequate attention to what was around them. dui.

Adult guidance is required The old claiming "do as I state, not as I do" does not use when it concerns driving. Children discover from their parents starting at a very early age, as they are regularly observing as well as mimicking their parents' habits. Parents need to lead by example and take down the diversions if they expect their teens to do the very same.

These laws enable teens to obtain useful driving experience before they are provided full certificate advantages and parents ought to be thorough concerning ensuring their youngsters are sticking to them – cheap insurance. Dedicate to being an accountable driver Activities speak louder than words. While teenagers may assure to act sensibly when not under their moms and dads' watchful eyes, they may be attracted to damage the policies when driving on their very own.

The Definitive Guide for How Much Does Car Insurance Cost For An 18-year-old In …

Contracts are binding, so moms and dads ought to be sure to talk about the specifics of what they're signing with their teen before turning over the cars and truck keys. For even more pointers to decrease the number of teen accidents and casualties, check out Mercury's Drive Safe Challenge, a system for parents as well as teens to have serious discussions concerning driving – vehicle insurance.

You can additionally find additional root causes of teen driving collisions and just how to shield against them – cheapest car.

risks prices cheap auto insurance cheapest car

risks prices cheap auto insurance cheapest carWhen it concerns insurance policy, it pays to be a risk-free chauffeur. cheaper car insurance. Teen vehicle drivers currently pay more for auto insurance coverage than even more knowledgeable motorists, and also if you're not complying with the guidelines of the road, your costs will certainly be even greater. Insurer take into consideration teens a greater danger, due to the fact that unskilled chauffeurs are a lot more likely to get involved in accidents – affordable car insurance.

cheap insurance low-cost auto insurance car insured insurance companies

cheap insurance low-cost auto insurance car insured insurance companiesWhy do I need car insurance policy? In North Carolina, you are needed to have automobile obligation insurance coverage to lawfully drive. If you trigger a mishap, insurance policy helps pay for injuries and also property damages you create to others.

Car Insurance For 18-year-olds: Average Rates For Coverage Fundamentals Explained

If you drive without insurance policy (accident)… You can be ticketed and fined. Your vehicle enrollment could be suspended. Your car might be taken. As a moms and dad, just how can I maintain my teen motorist safe? If you are a parent of an adolescent vehicle driver, your child's safety and security is your initial concern. Though you can not constantly be by their side, there are points you can do to help keep them secure behind the wheel.

While teenager driving statistics are unpleasant, research study recommends parents that set guidelines reduce mishap risk in fifty percent (dui).

(And also if you're insuring your teenager on your policy, you have actually already taken something of a struck so you're just tackling one more car and also designating your teen as the driver.) Right here are some points to take into consideration: What sort of car would certainly you get? While it's a subjective decision with numerous variables to think about, you might wish to think about the effect your selection will have on your car insurance rates – insurance.

If you choose you desire to go the hybrid auto course, be sure to explore whether there is a hybrid discount offered. vehicle insurance. You will also wish to get in touch with your insurer before you purchase to see to it the vehicle you're considering won't set you back an arm and a leg to guarantee due to its online reputation as being costly to repair.

Indicators on Teen Safe Driving Program & Discount – American Family … You Need To Know

You might get a discount for a vehicle that isn't overdoing the miles or used in an extensive job commute. Bundling means buying greater than one kind of insurance policy from the exact same firm. So, as an example, where available, you can purchase both your house as well as your auto protection from the same insurance company and usually that company will certainly offer you a price cut on one or both plans.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.